"Big banks like Chase that are set up to be too big to fail, are failing. And so we shouldn't have to be dealing with this crisis once it happens as communities," said Denise Diaz, executive director of the Central Florida chapter of Jobs for Justice.

Diaz was in Charlotte last week for Bank of America's annual shareholder meeting, part of what activists are calling the "Shareholder Spring."

The fact is, the country's biggest banks are getting bigger.

According to Bloomberg Businessweek, the five biggest U.S. banks (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo and Goldman Sachs) held $8.5 trillion in assets at the end of 2011, equal to 56 percent of the country's economy. Five years earlier, before the financial crisis, the biggest banks' holdings amounted to 43 percent of U.S. output.

A former Chase employee, Linda Altamonte, made the drive from Orlando to refer to her own battles with the bank. Altamonte was fired in 2009 after she brought concerns to her bosses in San Antonio about errors in credit card judgments (Rolling Stone's Matt Taibbi wrote about her in March and says she will be featured in his next book).

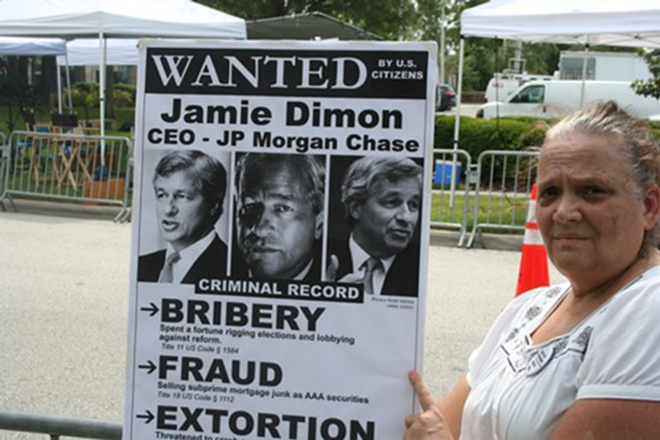

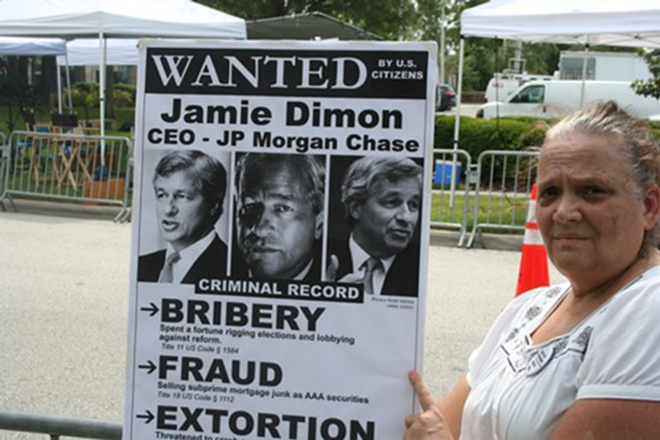

Marilyn Lyday from Occupy Tampa said she drove more than an hour to Tampa to raise awareness of the situation with the banking system in America.

"We're in an economic mess right now," she said. "CEOs are making phenomenal bonuses. The companies are making profits and I want them to be tried in a court of law and prosecuted, I want them to be fined, I want them jailed and I want them to return the money and let the American worker get back on their feet."

Tampa activist Kelly Benjamin said he also wasn't surprised to learn of JPMorgan Chase's loss last week, which has cost the company nearly 10 percent of its stock price.

Alluding to reports about the bank's involvement in foreclosing on homes, he took exception to Dimon's remarks that the financial loss won't adversely affect Chase or the economy.

"I don't think there's been an appropriate amount of remorse for what's going on. If somebody else lost $2 billion in any other industry, you would be fired," Benjamin said. "I think ultimately this is a problem that's going to happen again until we force the issue into the public and get some solid changes."

Joe Jay said he became engaged in activism through Occupy Tampa but now works with groups like organized labor and the Florida Consumer Action Network (FCAN). He said he does believe elections can make a difference, but mostly at the local level. He said he does hope Obama wins, because he believes the president will be more affected by massive protests against weak bank regulations than Mitt Romney would be. When asked if Obama could be stronger in policing Wall Street, Jay doubts anyone could do better.

"Have the results been weak? Yes, but could any president have done better? I don't think so. The electoral process has been corrupted by money and you can't get into money without Wall Street. And that sucks," he lamented.